In today’s dynamic business landscape, managing expenses effectively is paramount for financial success. Business expense tracking software has emerged as an indispensable tool, empowering businesses to streamline their expense management processes, optimize spending, and make informed financial decisions.

From tracking receipts and categorizing expenses to generating insightful reports and simplifying tax compliance, business expense tracking software offers a comprehensive solution to streamline your expense management operations.

Definition and Overview

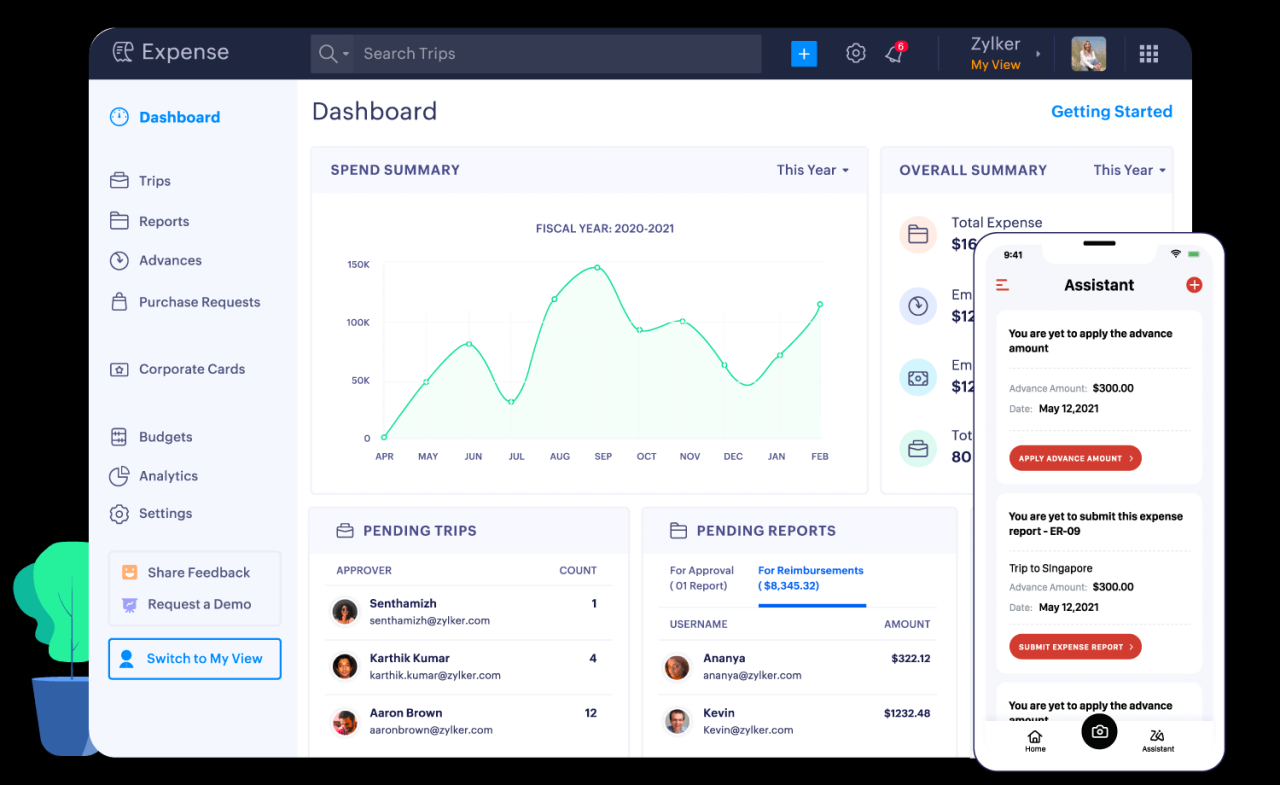

Business expense tracking software is a digital tool designed to help businesses manage and track their expenses. It allows them to capture, categorize, and analyze their spending, providing valuable insights and streamlining expense management processes.

By automating expense reporting and eliminating manual data entry, this software helps businesses improve accuracy, save time, and make informed decisions based on real-time expense data.

Benefits

- Improved expense visibility and control

- Reduced manual data entry and errors

- Enhanced compliance and auditability

- Real-time expense insights and analytics

- Increased productivity and cost savings

Features and Functionality

Business expense tracking software provides an array of essential features and functionalities designed to streamline expense management processes, enhance accuracy, and improve compliance.

These software solutions typically offer the following core functionalities:

Expense Categorization

Expense categorization is a crucial feature that enables businesses to classify and organize expenses into predefined categories, such as travel, entertainment, or supplies. This categorization simplifies expense analysis, budgeting, and reporting.

Receipt Capture

Receipt capture functionality allows users to capture and store receipts digitally. This feature eliminates the need for manual data entry and reduces the risk of errors. Users can capture receipts through mobile apps, email, or desktop scanners.

Reporting

Reporting capabilities are essential for providing insights into expense patterns and trends. Expense tracking software generates customizable reports that can be used for expense analysis, budgeting, and compliance purposes.

Types and Comparison

Business expense tracking software comes in various types, each catering to specific business needs and complexities. Understanding the differences between these types can help businesses choose the most suitable solution for their operations.

The primary types of business expense tracking software include:

- Standalone Software: These programs are designed solely for expense tracking and do not integrate with other business systems. They offer basic functionality, such as expense entry, categorization, and reporting.

- Integrated Software: These programs are part of a comprehensive business management suite that includes modules for accounting, payroll, and other functions. They provide a seamless integration between expense tracking and other business processes.

- Cloud-Based Software: These programs are hosted on remote servers and accessed via the internet. They offer flexibility, accessibility, and scalability, as businesses can access their data from any location with an internet connection.

- Mobile Applications: These apps are designed for use on smartphones and tablets. They allow employees to capture expenses on the go, reducing the need for manual entry and improving accuracy.

Comparison Table

The following table provides a comparison of the key differences and strengths of the different types of business expense tracking software:

| Feature | Standalone Software | Integrated Software | Cloud-Based Software | Mobile Applications |

|---|---|---|---|---|

| Functionality | Basic expense tracking | Comprehensive business management | Expense tracking, collaboration | Expense capture, on-the-go access |

| Integration | None | Seamless integration | Limited integration | None |

| Accessibility | Local installation | Local or remote access | Internet connection required | Mobile device required |

| Scalability | Limited scalability | High scalability | High scalability | Limited scalability |

| Cost | Low to moderate | Moderate to high | Subscription-based pricing | Low to moderate |

Benefits and Advantages

![]()

Business expense tracking software offers numerous benefits that can significantly improve business operations. It enhances efficiency, reduces costs, and streamlines processes, leading to improved profitability and financial health.

One of the primary benefits of expense tracking software is its ability to streamline the expense management process. It eliminates manual data entry and automates tasks, such as invoice processing and expense report creation, saving businesses valuable time and resources.

This streamlined process also reduces the risk of errors, ensuring accuracy and compliance.

Improved Efficiency

- Automates expense tracking and report generation, saving time and effort.

- Eliminates manual data entry, reducing the risk of errors and improving accuracy.

- Provides real-time visibility into expenses, enabling timely decision-making.

Reduced Costs

- Negotiates discounts with vendors based on expense data, leading to cost savings.

- Identifies duplicate or unnecessary expenses, helping businesses eliminate waste.

- Provides insights into spending patterns, enabling businesses to optimize their budgets.

Streamlined Processes

- Integrates with accounting systems, automating data transfer and reducing manual effort.

- Enforces expense policies, ensuring compliance and reducing the risk of fraud.

- Provides mobile access, allowing employees to track expenses on the go.

5. Considerations and Selection

Selecting the most appropriate business expense tracking software for a business requires careful consideration of several key factors. Understanding these factors ensures businesses make informed decisions aligned with their specific requirements and objectives.

The evaluation process should involve a thorough assessment of the software’s capabilities, ease of use, integration with existing systems, and cost-effectiveness. By evaluating these aspects, businesses can identify the software that best meets their unique needs and helps them achieve their expense management goals.

Features and Functionality

- Expense Tracking Capabilities: Assess the software’s ability to capture and track various types of expenses, including receipts, invoices, and mileage.

- Reporting and Analytics: Evaluate the software’s reporting capabilities, including the ability to generate customized reports, track expenses by category, and identify trends.

- Integration with Accounting Systems: Consider the software’s ability to integrate with existing accounting systems, such as QuickBooks or Xero, to streamline expense management processes.

- Mobile Accessibility: Assess the software’s mobile accessibility, allowing employees to track expenses on the go and submit receipts remotely.

- Security and Compliance: Evaluate the software’s security measures to ensure data protection and compliance with relevant regulations.

Implementation and Best Practices

Implementing business expense tracking software involves careful planning, execution, and ongoing management to ensure its effectiveness and user adoption. Best practices can guide organizations in realizing the full potential of this technology.

The implementation process typically includes:

- Define goals and objectives: Clearly outlining the desired outcomes and aligning them with the organization’s overall financial strategy.

- Select the right software: Evaluating various options based on features, functionality, user interface, and compatibility with existing systems.

- Configure and customize: Tailoring the software to meet specific business needs, including expense categories, approval workflows, and reporting requirements.

- Train users: Providing comprehensive training to ensure users understand the software’s capabilities and how to use it effectively.

- Integrate with other systems: Connecting the expense tracking software with other relevant systems, such as accounting or enterprise resource planning (ERP) systems, to streamline data flow and eliminate manual data entry.

- Monitor and evaluate: Regularly reviewing usage, identifying areas for improvement, and making adjustments as needed to optimize performance.

Best Practices for Maximizing Effectiveness

To maximize the effectiveness of business expense tracking software, organizations should adopt best practices that encourage user adoption and ensure data accuracy and reliability:

- Make it easy to use: Ensuring the software has a user-friendly interface, intuitive navigation, and accessible support resources.

- Promote user adoption: Encouraging employees to use the software consistently by highlighting its benefits and providing incentives for participation.

- Establish clear policies and procedures: Defining guidelines for expense submission, approval, and reimbursement to ensure compliance and accountability.

- Regularly review and update: Continuously monitoring the software’s performance, identifying areas for improvement, and making necessary updates to enhance its functionality and user experience.

- Foster a culture of accountability: Emphasizing the importance of accurate and timely expense reporting and holding employees accountable for their submissions.

7. Emerging Trends and Future Outlook

![]()

Business expense tracking software is continuously evolving to meet the changing needs of businesses. Some of the latest trends in this technology include:

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are being used to automate many tasks in business expense tracking software, such as data entry, receipt scanning, and fraud detection.

- Mobile-first design: More and more businesses are using mobile devices to track their expenses, so software providers are developing mobile-first designs that are easy to use on smartphones and tablets.

- Integration with other business systems: Expense tracking software is being integrated with other business systems, such as accounting software and CRM systems, to provide a more comprehensive view of business performance.

These trends are expected to continue in the future, as businesses increasingly rely on technology to manage their expenses. In addition, we can expect to see new and innovative features added to expense tracking software, such as:

- Real-time tracking: Expense tracking software will be able to track expenses in real time, so businesses can have a more up-to-date view of their spending.

- Predictive analytics: Expense tracking software will be able to use predictive analytics to identify potential areas of overspending and recommend ways to save money.

- Personalized recommendations: Expense tracking software will be able to provide personalized recommendations to businesses based on their spending habits.

These advancements in expense tracking software will help businesses to save time and money, and to make better decisions about their spending.

Closure

By leveraging the capabilities of business expense tracking software, businesses can unlock significant benefits, including improved efficiency, reduced costs, enhanced compliance, and empowered decision-making. As technology continues to advance, we can expect even more innovative features and advancements in this space, further revolutionizing the way businesses manage their expenses.